Dave:

Something pretty remarkable happened this week that’s going to impact every real estate investor. The House of Representatives just passed the Housing for the 21st Century Act by a vote of 390 to nine. Let that sink in for a minute. 390 to nine. In 2026 in this Congress, when was the last time you saw that kind of bipartisan support and agreement on anything? And this bill is all about real estate. It touches everything from zoning reform to manufactured housing to how community banks can lend. And if this bill actually becomes law, it could truly reshape where and how housing gets built in this country and could help eliminate the housing shortage we’ve had since the great financial crisis. So today we’re going to break this all down. I’m going to go into exactly what’s in the bill, what it means for real estate investors at every level, and why I personally think this could be one of the most important policy shifts for the housing market that we’ve seen in years.

Everyone, it’s Dave. Welcome to On the Market. This Monday, we saw something that happens pretty rarely these days actually happen. A bipartisan bill passed Congress with an overwhelming majority. And that bill is taking direct aim at the housing market. There is a lot in this bill, 37 total provisions to be exact. So although this isn’t officially law yet, if the bill gets passed, then personally I think there’s good reason to think it will get passed. If it does, real estate investors are going to need to pay attention to this. This is 37 new provisions directly impacting our industry. Now, of course, some of these provisions will be minor. They might not apply to you, but there are some ideas and policies in here that could really shake up the housing market. So today on the show, we’re digging into what we know so far, what the major ideas in the bill are, how these policies could be implemented.

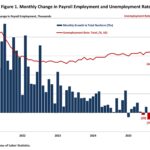

And of course, we’ll talk about what this means for investors. Let’s do it. All right. We’re going to get into the bills language and those 37 provisions, not all of them, but we’ll get into a lot of them, the most important ones in just a minute. But I think let’s just first talk about why. Of all the things Congress disagrees about, are we seeing bipartisan support for a housing bill? Well, first and foremost, because it’s a real problem in the United States. We talk about this on the show a lot, but affordability is near 40 year lows. It has gotten a little better last couple of months, but it’s still really low in a historical context. And of course, there are a lot of reasons for low affordability that we talk about, but we know that a lack of supply is one of, if not the biggest major issue.

And that lack of affordability is starting to weigh on people. People talk about it all the time. I don’t know if you guys witnessed this, but even people who aren’t in real estate, the unaffordability of housing in the United States is a problem. It is now a big issue for voters. It now ranks among the top three concerns for voters across the political spectrum. So this is a problem. Politicians know it and they’re starting to pay attention to it. We’ve already talked about several of the ideas and executive orders President Trump has implemented or started to talk about, but Congress is now paying attention and is also trying to pass legislation to improve affordability. Now, again, before we get into this, I do want to remind you all that this has only passed the House of Representatives, not the Senate, but there was a similar version of the bill called the Road to Housing Act, which was also bipartisan that already passed a Senate committee 24 to zero.

So we’re seeing in both chambers of Congress right now, a lot of bipartisan support. So although some of the provisions that we’re going to talk about today will probably be tweaked and modified before they go into law, there is, I think, a very good chance that this does get implemented. We’re not talking about just some random idea. We’re actually looking at what I think is a genuine shift in political priorities around housing supply. So we got to get ahead of it. That’s why we’re digging into this today on On the Market. With that said, let’s talk about this bill. So the bill itself actually has six different sections. They call them titles. So there’s six different titles, and within them, there are a couple of different provisions. And before I cherry pick the provisions that I think will matter most, because I’m not going to sit here and list 37 different provisions for you.

I’m going to talk about the ones I personally think are going to be most impactful for the BiggerPockets and on the market community here. But before we do that, I just want to give you a roadmap of what each of these six titles is about so you have the big picture. The first one is called Building Smarter. The idea here is about zoning reform, construction streamlining, and some overhauls to environmental reviews. I think this one is going to be super important for our community. I’m going to dig into this one a lot. The second title is Local Development and Rural Housing. This affects a couple of grant programs, specifically in rural areas. So I do think this will have some impact for our community. The third, this is kind of my sleeper favorite one. It’s called manufacturer housing and finance. This is redefining what manufactured homes are, which may not sound like a lot, but I actually think has the potential to bring down construction costs, which I’m excited about.

Title four is Borrow and Family Protections. This is mostly doing with veterans groups. So for most people in the community here at BiggerPockets, not going to be impactful, but if you are active duty military or a veteran, you’re definitely going to want to pay attention to that because there’s some interesting positive stuff there. Number five is housing provider oversight. This is stuff like accountability for HUD and some housing agent transparency. Important things not really going to impact you day-to-day as a real estate investor. And then number six, which I think is pretty interesting too, is about community banking. It basically allows community banks to start more easily, changes some deposit rules. So if you use community banks, this is going to be really positive as well. So that’s the big picture, but let’s dig into each section and what it’s going to mean. Again, if you want to read it all, go look at the 37 provisions, but I’m going to highlight the ones that I personally think have the biggest impact.

We’re going to start with title one, which is building smarter. I’m not going to bury the lead here. I’m just going to just come out and say, I think this one is really important. We talk about housing supply and why there’s such a shortage all the time. Construction costs and regulation are big impediments to supply. That’s just the reality of it. And this building smarter part of the bill tries to tackle it directly. The first thing it does is creates a exclusion program for something called the NEPA, which is basically environmental reviews for a bunch of different types of housing activities from rehab projects, urban, infill construction, small scale builds. So for these types of deals, we have to get the details of it, but for more types of development, you are going to be able to streamline or actually be excluded from environmental reviews.

Now, I’m not saying that environmental reviews are bad, but they take a really long time. If you actually dig into these types of things, sometimes it can take projects months or even years to get approved because they go through continuous environmental review. That makes development really long, but it makes it even more expensive because you have all these holding costs. And it actually, according to all the research I’ve done, slows down a lot of development and limits housing supply. So this goes right after one of the biggest impediments to development and could be really impactful. So this goes right after that. And this is the kind of thing that really does bring down construction costs because if you think about what levers the government has to pull to bring down construction costs, they can’t lower the price of lumber. They can’t lower the price of labor, but they can streamline these types of things that increase holding costs like environmental reviews.

So I think this one could have a really big positive impact on housing supply. The second thing in this build smarter title, it goes after the same idea, trying to reduce the time it takes to develop housing and how much it costs to develop that housing. So the second thing is this pre-approved design pattern books they’re calling. And this is actually something we talked about on the market as an idea a couple years ago. So you know that I’m a fan of it, but basically HUD’s going to fund a pilot program for pre-reviewed building designs that are automatically code compliant. Think about it right now. If you want to go and build something, you have an architect, you have engineers, you build something, you submit it to the planning department, they check if it’s code compliant, that can take months, that increases your holding costs.

But what if there was just sort of a catalog that you could look through of pre-approved home design that allowed you to skip the month-long permitting review process because it’s already approved? This is just a pilot program right now, but I really like this idea. It’s only going to be in certain markets apparently, but I think this is a really cool idea for them to be testing because if it works, this could really help bring down costs as well. The third thing that I want to mention in that build smarter category is FHA multifamily loan limit updates. Basically, this updates the statutory max loan limits for FHA insured multifamily construction to actually reflect current costs and it pegs them going forward to a construction cost inflation formula so that they doesn’t need to keep getting updated because it’s been a while. It’s a bit outdated.

And so hopefully this will help finance multifamily construction as well. So those are the big three in Title I. There’s also a provision directing HUD to publish voluntary zoning best practice guidelines. Another idea that I like, but it’s voluntary, so I don’t know how many cities are actually going to do it. They could voluntarily change their zoning right now, but they’re choosing not to. So I don’t know how much that will do, but I like the encouragement at very least. So those are the three big ones in Title I. With that, let’s move on to Title II, which again is local development and rural housing. This whole section is basically about modernizing two of the biggest block grant programs that we have in the United States, home and CDBG, and improving rural housing. There are two provisions I’ll talk about. The first is the home program overhaul.

You never heard of this. It’s the largest federal block grant for affordable housing supply, and it really hasn’t been updated in a long time. And so what this bill has in it is expanding eligibility for these block programs to workforce income households. So it’s not just people with the lowest incomes. It updates sort of outdated limits that haven’t caught up with costs today. It exempts small scale projects from environmental mandates, and it gives local jurisdiction more time and more flexibility in how to deploy those funds. So if you invest or active in areas that use home funds, I think there are going to be more projects that actually make sense, which is good news. So the second thing is the CDBG public land database. First change here is that basically communities that receive these kinds of grants, they need to maintain a searchable database of undeveloped government-owned land.

It’s like this sort of a prospecting tool or discovery tool for developers. It’s an interesting idea. I’m not sure it’s going to make a huge differences. Developers build in popular spots and any developer worth their weight should already know where undeveloped land is in popular spots, but maybe it will help. The second thing is that communities can now direct up to 20% of the funds towards affordable housing construction specifically, so I do think that could help housing supply as well. So those are the two bigger ones here. There are a couple other things like regional housing planning grants. There are some changes and expansion to the Section 504 home replant program. A lot of stuff like that, that if you operate in a rural area, you’re going to want to dig into. I’m not going to get into more detail now, but if you’re in rural markets, go check out this Title II of the new Act, because there’s a lot of interesting stuff in there.

With that though, I want to move on to Title III, which is my sleeper for my favorite part of this bill, but we do have to take a quick break. We’ll get to that right after this.

Welcome back to On The Market. I’m Dave Meyer going through the new bipartisan bill that just passed the House of Representatives that could really reshape housing supply in the United States. We’re going through the bill right now. We’ve gone through Title one and two. Now, let’s move on to Title III, which is manufactured housing and affordable finance. I got to say, I think this is kind of the sleeper section of the bill. I really like this stuff. Basically, they’re redefining what a manufactured home is to include housing built without a permanent chassis. This has been a problem for a while. Basically, currently, it is hard to get a loan for some manufactured homes, just based on the definition. This change could mean that modular and factory built homes, which I should say are typically 20 or 30% cheaper to build than things that are built on site.

Those types of homes now can get financing from HUD, which will make them much more attractive and will make it easier for these types of deals to pencil for developers or people who want to build homes. I like this because this financing barrier has been the main thing, I think, holding back factory built housing. Again, it could be 20, 30, maybe even more percent cheaper to build these kinds of homes. This is the kind of innovation that we need in the United States right now. I have not seen anything, maybe 3D printing housing. I’ve not seen a lot of ideas that will bring down construction onsite doing these infill projects, but we already know that pre-manufactured housing is at least 20 or 30% cheaper. And so if you make that more accessible, that could bring down overall construction costs. So I do really like this.

There’s one other provision in this title that makes it easier for people to get actually mortgages on really cheap houses. It’s kind of this weird thing, but it’s kind of hard to get a mortgage under $100,000. They’re opening that back up, which will help in certain parts of the country, probably the Midwest. Most people are probably jealous that they even have that problem of trying to find a mortgage for house under $100,000. But anyway, that is title three. We’re going to move quickly through Title IV, which is borrow and family protections. Basically, it’s mostly consumer protection and veteran benefits. Really important stuff, great policy, but lower direct impact for most investors. Number five, housing provider oversight. This requires the HUD secretary testify before Congress annually. Housing agencies are going to have more oversight. So good stuff, again, not going to directly impact any of us here that much.

So we’re going to skip over that and go to Title VI, the last one, community banking. I know banking regulation sounds dry, but if you’re buying rentals or doing development, this stuff matters. I mean, you hear me, Henry, James, Kathy talk about it all the time. Community banks are a really powerful tool in financing, and this is going to hopefully expand access to community banks. One of the provisions is basically bank exam relief and offers some flexibility on deposit requirements. Basically, if your community bank qualifies, there’s going to be less regulation and red tape, and they will be able to lend more on real estate projects. The other thing that they’re introducing here is that new bank charters are going to be streamlined. So hopefully, that means we’ll get new regional and local banks that has not been happening a lot recently. Basically, there’s been a lot of consolidation in the lending industry.

And so this provision actually is encouraging more local banks. I’m not an expert on that, so I don’t know if that’s going to happen, but I like the idea of trying to encourage local competition because local and community banks do provide a really positive role for real estate investors and homeowners in most markets. So bottom line here on Title VI, anything that makes community banks healthier, more willing to lend, I think is good for our community and for housing supply in general. So I like this as well. So that’s what’s in the bill. There’s plenty more. Like I said, there’s 37 different provisions. I covered about 10 of them that I think are important. Go check it out if you want to learn the rest. But before I give you some other thoughts on what’s going on here, I want to just also talk about what’s not in the bill because a lot about housing policy has been discussed recently, and not everything that’s been in the news is in the bill.

Notably, there is no ban on institutional investors. Trump signed an executive order three weeks ago targeting Wall Street buyers of single family homes. This bill doesn’t include any provisions formalizing that ban, so we really don’t know if and how that will work. The second thing I think that’s really important is that there’s not new federal funding for any of these programs, right? This is policy reform. It’s not like the government is all of a saying we’re investing billions and billions and billions of dollars into new construction or anything like that. It’s policy reform that will hopefully help. The idea is that it will help local jurisdictions and private investors and private individuals create new supply without the government actually going out and funding that itself. There’s also no rent control in here. There is no mortgage rate relief ideas in here. This is really focusing on housing supply.

This is a fundamentally supply side bill, and I think that’s really important to investors. The philosophy here seems to be remove barriers, modernize programs, and let the market build more. That’s good. I did a whole episode recently, I think it was like two or three weeks ago, about demand side policy. I was saying that Trump and his administration have introduced a lot of ideas to help housing affordability, but it was almost entirely demand side, meaning that it helps buyers buy more homes. But my point in that episode was that, yes, demand side stuff can help, but if you don’t pair that with supply side fixes, it actually makes the problem worse, right? Because you’re inducing more demand without increasing supply that pushes prices up. So in my opinion, supply side is what fixes things long term, and that’s why I like a lot of the ideas in this bill.

I am not saying this is going to fix things overnight. It will not. It’s going to take a while and there are probably more policy changes that need to happen as well, but I like the idea that Congress is passing bipartisan laws that are focused on supply issues in the housing market. That is what fixes things long term. Demand side help can be important during a crisis. It can be important for certain demographics and people in our country, but those are bandaids without a supply fix. And so that’s why I’m excited because we’re finally talking about supply side fixes. All right. We got to turn our attention now to what this means for investors, but we got to take one more quick break. We’ll be right back.

Welcome back to On The Market. I’m Dave Meyer talking about the new bipartisan housing bill making its way through Congress. We have talked about what’s in the bill, what’s not in the bill, and now let’s talk a little bit about what this means for investors. And I want to sort of get the elephant in the room out of the way because one of the main reasons we have an affordability crisis in this country is because people, they say they want more housing, but they don’t actually want more housing. This is this whole idea of NIMBYism, not in my backyard. Most people know that when you suppress supply, you stop people from building, you get more appreciation. And so they stop multifamily development or more houses from being built in their neighborhoods because it keeps their home prices up and increases appreciation. On the other hand, when there is more supply, that can slow down appreciation and a lot of homeowners don’t like that.

Look at Austin, Texas, for example. They have a supply glut and prices are falling because of it, and a lot of homeowners don’t want that. And I bet there are some investors out there who don’t want more supply because they want rapid appreciation or they don’t want their home values, property values to sink. But I’m just going to tell you, I believe that more housing supply is a good thing for investors, for homeowners, for everyone. And I’m going to tell you why. First, it’s just good for our country. Homeownership has long been part of the American dream. It is an important component of building wealth and stability for your family. It’s provides security and predictability to families. And I just believe that homeownership should be within reach to average Americans, not just wealthy people or investors, which is what the housing market has become of late.

We can measure this in the United States. The average person in the United States cannot afford the average price home, and I think that’s a problem. The second thing is a more predictable market. I believe as an investor is a better market. Supply constraints create unpredictable conditions like we’ve seen the last few years. We get huge appreciation. Now we have a long contraction. Housing, ideally, should be more stable. I say this all the time. I would love to get back to a place where we could just count on the housing market going up close to the pace of inflation every year, two, three, 4%. I think better balance between supply and demand would get us there, and that makes better conditions as a real estate investor. For those of us who are just trying to build financial freedom over the long run, that’s a market we can definitely work with.

Third, more supply makes building a portfolio easier. This would lower entry points and help grow portfolios. It is not just homeowners who are struggling with affordability right now, but new investors trying to get into the game, people who want to add to their portfolio are also struggling to get into the market and more supply should help the market become more affordable. Fourth reason, real estate worked even before there was a housing shortage, right? We don’t need this. I get some homeowners think that they need to constrain supply for their home to have value. But as real estate investors, we don’t need that. We don’t need homeowners to be squeezed. We don’t need families to be rent burdened. We don’t need first-time home buyers to be squeezed out of the market. We just don’t need it. Real estate can and should be a profitable business that adds value to our society without keeping the housing supply scarce.

This business worked long before there was a housing shortage and it will work again. I think we’ll work better if supply and demand were better balanced. The last thing I’ll say about adding supply and why I think this is such a good idea is because it allows us as real estate investors to play a positive role in communities. We need more housing in this country. Whether you believe it’s three million short or seven million short, we need more housing. And if this bill passes or something similar or just in general, it may get easier for you, literally you as a real estate investor, to provide that value to your community. And I love that. You could help solve a problem in your community and build a great business at the same time. To me, that is a win-win situation. Now, some people may disagree, but as you can tell, I really think that we need more supply in the United States and I’m standing by it.

With that said though, let’s talk about what some of these provisions actually mean for investors on the ground. First, I’ll say for anyone who’s thinking about development or adding value, adding capacity, there’s a lot of good stuff in here. From the NEPA streamlining, these ideas behind pattern book programs, loan limit updates for FHA multifamily, these ideas could meaningfully reduce your timelines and expand what you can build. More things will start to pencil. So I personally, if you’re interested in development, I dig into this stuff right now. See how these ideas, even though they’re not finalized, how they might apply in your market. I think if you can get a jumpstart on some of these development ideas, you could have an advantage in your market. So I would definitely check that out. The second thing is I’m personally really interested to see what happens with the manufactured homes.

I need to learn more about this, but I just love the concept of being able to mass manufacture housing at 20 or 30% below other costs and use that either for urban infill or building developments, whatever it is, I’m going to look a lot into that and I’ll share with you what I learned, but I just think that’s another thing. If you are a developer or value add investor, you should be looking at. For buy and hold investors, I think there’s a couple things. One, can you work with a developer and do some build to rent? Because if development is getting easier, like we were just talking about, but you’re not a developer, built to rent could be a good option because you might find people who want to build and develop, but don’t want to hold and operate properties. So I think that’s going to be a really interesting opportunity.

We’ve seen institutional investors doing a lot of build for rent. For the last couple years, it makes more sense for them financially, but I think this could be more available to small and medium size investors with some of these provisions to work with small and medium sized developers as well. The second thing is when you’re underwriting deals, I think you have to really watch supply growth carefully. Now, we don’t know if this bill is really going to lead to an explosion of construction and supply. I think it will take some time. I don’t think it’s going to happen overnight. It’s probably going to take years. But it’s something that I talk about a lot with just people when I’m traveling around and talking to people. I think everyone when they’re evaluating markets and underwriting deals, they’re all looking at demand side. How many people are moving there?

How many jobs are there? That’s all important and good. But supply side matters a lot. Ask anyone in Austin, Texas. Ask anyone in Phoenix right now, right? Ask anyone in Florida right now. When there is a lot of supply that comes online quickly, it can lead to a contraction in the market or slower growth times. Now, I’m not saying that you can’t buy or operate in areas where supply is getting added. I just made a strong argument that I think supplies should be added. I just want to say that you need to track it carefully to try and make sure that you are underwriting appropriately. If you are going to buy something that’s next to a new housing development, you probably shouldn’t expect a lot of appreciation in the next couple of years because there’s going to be a lot of supply coming online. That is okay, but you need to underwrite for it and therefore pay less for that asset because it’s not going to perform the same.

In a lot of markets in the last couple of years, it’s been easy to ignore supply side because there’s been so much demand, but because we’re in a correction right now, a contraction in the market, and because we might see more supply, I think this is going to be more and more important and something that you should focus on in your underwriting. The other two things that I will mention are watch what happens with this institutional investor policy. It’s not in here. I personally don’t think it’s going to amount to much, but it will matter. If there is a real ban on institutional investors buying single family homes, I think it’s going to create sort of this sweet spot for small and medium size investors who want to do buy and hold. We’ll obviously cover that on a future episode if it actually does take shape, but it’s something I just wanted to mention because it’s not in here, but it would matter.

And then the last thing I’ll just say is look at your funding options. If you are developing or working in rural areas, if you’re a veteran, if you’re looking in low income areas, there are more and more funding options available. Also, look to your community banks. They might be able to introduce new programs. They might have higher limits. They might have new first-time home buyer programs because of these policies. So even if you’ve done your research in the past, go do it again. Look through different funding options for your next deal if this bill goes into place because there might be better options for you. There’s a lot in here that is designed to do just that. All right, so those are my feelings about the bill. Obviously, we’ll learn more if it actually gets passed and we can talk about some of the provisions as we get more details, but these are the big high level things that are in the bill.

And overall, I like what I see here. Supply side policy is what is needed. It is not a silver bullet. It is not going to help immediately. There is still a lot of work to do to restore housing supply in the United States, but I think there are worthy ideas here that are a step in the right direction. And although we don’t know the exact impact, personally, I’m just happy to see the government talking about supply side solutions to the housing market, and maybe these will help us move in that direction and will lead to other policy changes or other ideas that can really help accelerate supply side growth in the housing market. The other thing I like about this is that it allows us as real estate investors to build successful businesses while also helping to address a major problem in our economy and help meet the needs of our community.

And like I always say, that’s the win-win type of scenarios that we should be looking to create as real estate investors. So hopefully this will help us all do that. That’s what we got for you today on On The Market. I’m Dave Meyer. Thank you all so much for listening. If you have any questions about this, you can always reach out to me on BiggerPockets or on Instagram. And if you thought this was helpful, share it with a friend, give us a like. We always appreciate it. Thanks again. We’ll see you next time.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].